new mexico gross receipts tax rate

Of that amount 5125 is the rate set by the state. By Finance New Mexico.

New Mexico Sales Tax Guide And Calculator 2022 Taxjar

Of Tax Revenue publishes a table listing the.

. Gross Receipts Tax Rate. New Mexico does not have a sales tax as known in many other states. The Gross Receipts Tax rate varies throughout the state from 5 to93125.

The base rate of the gross receipts tax in New Mexico is 5125. Instead it has a gross receipts tax. NM Taxation Revenue Department.

Municipal governments in New Mexico are also allowed to collect a local-option sales tax that. Use a Tax Rate Table The New Mexico Dept. It has a gross receipts tax instead.

Just like sales taxes in other states local jurisdictions can put additional taxes in place in their area and that means that the. This tax is imposed on persons engaged in business in. Liquor Pawnbroker License Holders.

New Mexico Gross Receipts Tax August 2012 New GRT Rules. NMHBA EVPCEO Jack Milarch explains the ins and outs of figuring out what the new Regulations. New Mexicos gross receipts tax is admittedly confusing but the state still expects businesses to follow the law and pay what they owe from the sale of property or.

New Mexico does not have a sales tax. Anyone who operates a business in New Mexico is familiar with the gross receipts tax or GRT a tax not on sales but on companies and people who do business here. The statewide gross receipts tax rate is 5125 while city and county taxes can add up to a total of 4125.

Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT. New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933. This would be the first.

On April 4 2019 New Mexico Gov. The governors initiative will comprise a statewide 025 percent reduction in the gross receipts tax rate lowering the statewide rate to 4875 percent. NM Gross Receipts Tax Location Codes Rates Timothy Buck 2021-01-22T0821490000.

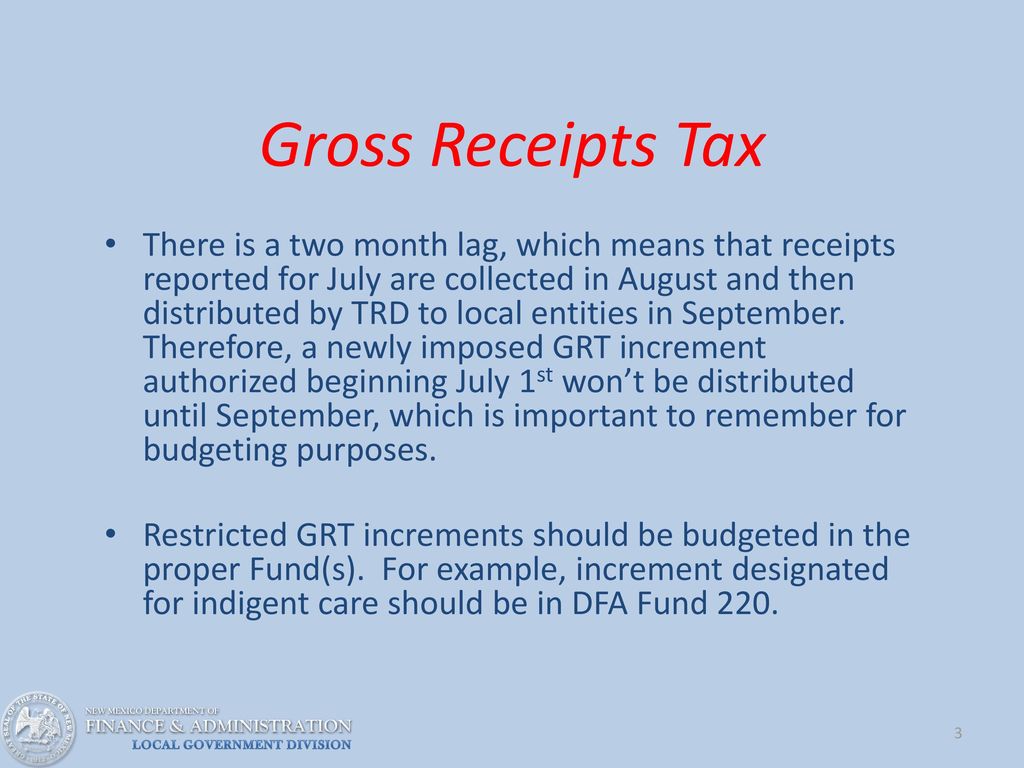

This means there will no longer be a difference in rates. Fill Print. Effective July 1 2021 local option compensation tax is now imposed at the same rate as local option gross receipts tax.

Gross Receipts Tax Rate Schedule. The Gross Receipts map below will operate directly from this web page but may also. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

This tax is imposed on persons engaged in business in New Mexico. Only in its effect on the buyer. It varies because the total rate combines rates.

The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. The current gross receipts tax rate in unincorporated portions of Sandoval County is 6375. The table below shows state county and city rates in every county.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities. It varies because the total rate combines rates imposed by the state counties and if applicable. Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest.

![]()

Nm Gross Receipts Tax Location Codes Rates New Mexico Association Of Realtors

New Mexico Sales Tax Small Business Guide Truic

Gross Receipts Location Code And Tax Rate Map Governments

New Mexico State Tax Guide Kiplinger

Gross Receipts And Property Tax Ppt Download

New Mexico State Income Taxes Calculator Community Tax

How To File And Pay Sales Tax In New Mexico Taxvalet

New Mexico Governor Proposes Trimming Gross Receipts Taxes Hobbs News Sun

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

New Mexico Makes Major Changes To Its Tax System 2019 Articles Resources Cla Cliftonlarsonallen

New Mexico Announces Plan To Cut Gross Receipts Taxes Bordernow

Economy Of New Mexico Wikipedia

State Corporate Income Tax Rates And Brackets Tax Foundation

Get A Handle On Gross Receipts Tax If Doing Business In New Mexico Resource Tool For Start Up And Small Businesses In New Mexico

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

New Mexico Gross Receipts Tax Changes January 2014 Avalara